Tax Credits 2025 Usa

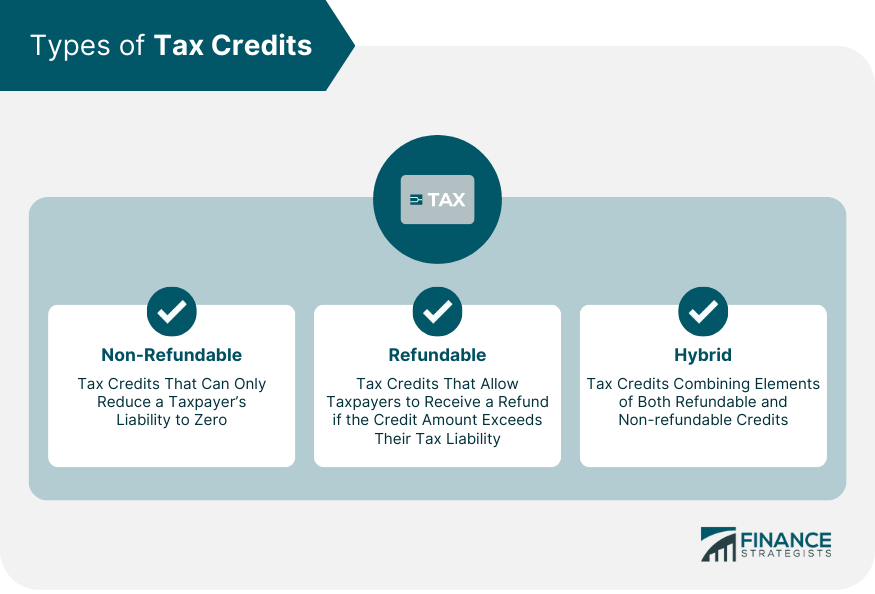

Tax Credits 2025 Usa. Nonrefundable tax credits are amounts directly deducted from an individual’s tax liability. There are many different tax credits and deductions.

But the flip side is, you may qualify for a slew of new tax credits and deductions. Tax credits are offered on both the federal and state levels to incentivize certain actions, such as purchasing an electric vehicle or to offset the cost of certain expenses (e.g., raising or.

Earned Tax Credit 2025 EITC Eligibility, Fill Online irs.gov, People should understand which credits and deductions they can claim and the records they need to show their eligibility.

Tax Relief For 2025 Tax Clare Desirae, Tax deductions lower your taxable income — how much of your income you actually pay tax on — while.

600 Earned Tax Credit 2025 Know Limit & EITC Refunds Date, While the package is far from ideal, it.

Earned Tax Credit for 2025. StepbyStep Guide YouTube, Everything you need to know about the 2025 child tax credit (ctc), including eligibility, income limits, and how to claim up to $2,000 per child on your federal tax return.

IRS Issues Table for Calculating Premium Tax Credit for 2025 CPA, Nonrefundable tax credits are amounts directly deducted from an individual’s tax liability.

Child Tax Credit 2025 Know about USA CTC Amount and How can You, There are three categories of tax credits:

Child Tax Credit 2025 Qualifications Hetty Laraine, Most tax credits can reduce your tax only until it reaches $0.

New Tax Credits 2025 Rhea Velvet, Tax credits are offered on both the federal and state levels to incentivize certain actions, such as purchasing an electric vehicle or to offset the cost of certain expenses (e.g., raising or.